Achieving your homeownership dreams can feel daunting, but it doesn't have to be. With a variety of private home loan options available, you can obtain the financing you need to make your fantasy a reality. Whether you're facing standard lending obstacles or simply seeking more flexible terms, private home loans offer a compelling alternative.

- Discover how private home loans can help you navigate financing hurdles.

- Explore the benefits of working with a private lender and customize your loan to meet your specific needs.

- Get ready to embrace your homeownership objectives.

Obtain a Private Mortgage Even with Bad Credit

Facing financial hurdles due to poor credit? Don't despair. A private mortgage could be your solution. These loans are offered separately from traditional banks, showing they often have more tolerant lending criteria. Though your credit score may not be here perfect, you can still qualify for a private mortgage by exhibiting a strong revenue. Moreover, private lenders often take into account other factors like your possessions and professional history.

- Research different private lending options

- Compile all necessary financial documents

- Contact a reputable mortgage advisor

By adhering to these steps, you can increase your opportunities of securing a private mortgage, regardless of a less-than-perfect credit history.

Navigating Private Mortgage Lenders: A Guide for Borrowers

Private mortgage lenders can present both opportunities and obstacles for borrowers. Before entering with a private lender, it's crucial to conduct thorough research and comprehend the terrain.

Investigate different lenders meticulously, compare their terms, and acquire clear explanations of all fees involved. Verify that the lender is authorized and well-established.

A strong credit report is generally required for approval. Collect all applicable financial documents, such as income proof, tax returns, and asset declarations.

Interact openly and truthfully with the lender to address any concerns you may have.

Achieve Fast Approval & Flexible Terms with Private Mortgage Loans

Navigating the conventional mortgage landscape can be challenging. If you're seeking a swift approval process and adjustable terms, private mortgage loans may be the ideal solution for you. These credits offer a wealth of advantages that can streamline your homeownership journey. From lenient credit requirements to customized repayment plans, private mortgage loans provide the adaptability you need to make your dream of homeownership a reality.

- Explore the advantages of private mortgage loans today and unlock new possibilities of financial flexibility.

Unlocking Homeownership Through Private Loans

Are you dreaming to become a homeowner but facing obstacles due to your credit report? Don't discourage on your dream! Alternative private loan solutions are gaining popularity as a viable pathway to homeownership, regardless of your standing. These programs often offer more flexible terms compared to traditional mortgages, making them an attractive option for those with less-than-perfect credit.

- Discover the benefits of private loans and find out if they are the right match for your unique needs.

- Connect with a knowledgeable loan expert who can guide you through the journey.

Make control of your homeownership aspirations and discover the possibilities with private loan solutions.

Advantages of Choosing a Private Mortgage Lender

When exploring your mortgage choices, private lenders often present a compelling alternative. Unlike traditional banks, private lenders provide greater flexibility and consider your profile with a more personalized approach. This can be particularly advantageous for borrowers who may not qualify of conventional lenders due to circumstances like self-employment, unique income streams, or past credit issues.

A private lender's willingness to work with borrowers on a case-by-case basis can often result in a faster loan underwriting. Additionally, they may be more receptive of non-conventional collateral options.

Ultimately, choosing a private mortgage lender can offer a path to homeownership even for borrowers who may face difficulties when applying for loans from larger institutions.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Kirk Cameron Then & Now!

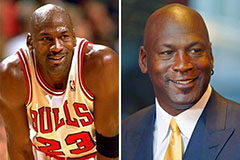

Kirk Cameron Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!